PRIVATE LIMITED COMPANY

Register your private limited comapany with IbizFilings and save more than

1000/-:

Your Private Limited Company With IbizFilings

Registering a Company is quick, easy, and can be done online with Ibiz Filings in 3 simple steps:

We help you register your directors with the Ministry of Corporate Affairs (MCA).

STEP - 1

<span data-metadata=""><span data-buffer="">We help you pick the right company name.

<span data-metadata=""><span data-buffer="">STEP - 2

We draft and file the documents required for your company registration (MoA and AoA).

STEP - 3

Overview

File your Indian company registration in minutes from the comfort of your home or office. Ibizfilings offers hassle-free online company registration in India backed by a team of highly qualified and experienced professionals.

Why Register a Private limited company?

Shields from personal liability and protects from other risks and losses.

Procures bank credits and good investment from reliable investors with ease.

Procures bank credits and good investment from reliable investors with ease.

Shields from personal liability and protects from other risks and losses.

Shields from personal liability and protects from other risks and losses.

Shields from personal liability and protects from other risks and losses.

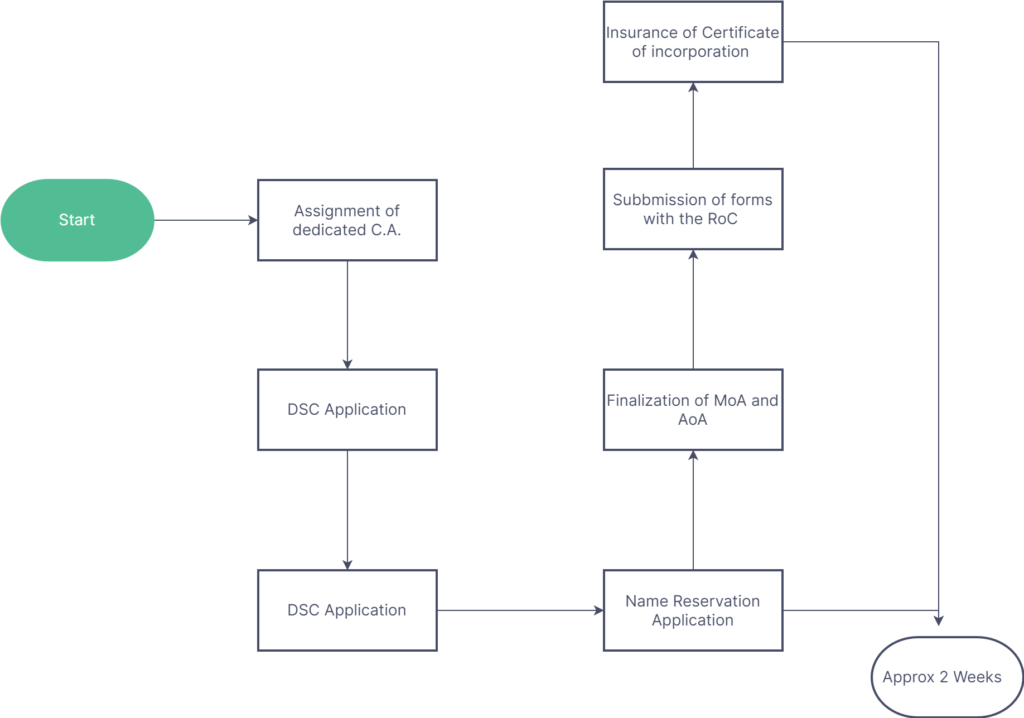

Company Registration Process

Document Checklist

Director KYC documents

- Scanned copies of Pan card and Aadhar of the Partners along with passport size photos

- Scanned copies of any one of the ID Proof of the Partners - Driving License/ Voter’s ID/ Passport copy

- Address Proof of the Partners - Bank Statement/ Telephone Bill/ Mobile Bill/ Electricity Bill (Latest Month scanned copies needed)

Director KYC documents

- Scanned copy of rent Agreement of registered office

- Latest Electricity Bill of registered office

- No Objection Certificate from the owner of the Premises, if not owned by the directors (format of NOC downloadable from dashboard)

Frequently Asked Question

A private limited company is the most flexible and credible structure of businesses. It is a type of structure with a clear distinction between ownership and management. In other words, investors and the people managing the company i.e. directors may be different. The Ministry of Corporate Affairs governs private limited company registration in India. Companies are incorporated and regulated under the Companies Act, 2013 and the Companies Incorporation Rules, 2014.

- 1. Separate legal entity: A private limited company is legally recognised as a separate entity. Hence, a company can have Permanent Account Number (PAN), bank accounts, licenses, approvals, contracts, assets and liabilities in its unique name.

- 2. Limited liability: Members of the private limited company have limited liability to the extent of their share in the company and personal assets of members cannot be utilized for the payment of the liabilities of the company under any circumstances.

- 3. Equity: A Private Limited Company can raise funds from the general public or entities interested in becoming a shareholder

- 4. Easy transferability of shares: Members can easily transfer the shares of a private limited company as they must simply file and sign the share transfer form and give it to the buyer of shares along with share certificates.

- 5. Trustworthy and credible: A private company has to follow statutory compliances and is monitored by a strict set of rules. All the knowledge is available on-line. Therefore, a Private Limited Company structure offers credibility and trustworthiness.

- Members: A Private Limited Company requires at least two members to register, both the members can be a director cum shareholder of the company. A Private Limited Company can have up to 200 people as members as per the Companies Act, 2013

- Directors: In a Private Limited Company there should be a minimum of two (2) directors. To become a director, a Director Identification Number (DIN) must be obtained. At least one of the Directors must be a Resident of India, who has stayed at least 182 days in the previous financial year but from Budget 2020 i.e. financial year from 2020-21, this period has been reduced to 120 days

- PAN card copies with Self-attestation.

- Voter Id copy or passport copy or aadhar card copy or Driving license copy with self-attestation.

- Latest bank account statement or mobile / telephone bill or electricity Bill (not older than two months)

- Passport size photo in jpg format

- For the registered office proof of the company, if the property is rented/ leased, copy of rental agreement or lease agreement.

- Copy of electricity bill or property tax receipt or water tax receipt not older than two months

- Copy of No Objection Certificate(NOC) from the owner of the property.

- If owned property, copy of sale deed and electricity bill is enough.

- In the case of NRI or foreign national, passport copy must be notarized at the Indian Embassy of the country.

- In case one of the shareholders or subscribers is a Corporate Entity(Company, LLP, etc.,) Certificate of Incorporation and MOA and AOA of the body corporate must be attached along with the resolution passed by the body corporate to subscribe to the shares of the company under incorporation.

A private Limited Company is the form of a company where a minimum of two members are required and the maximum number of members can be 200. The liability of the members of a Private Limited Company is limited to the number of shares held by them.

One Person Company means a Company which has only one person as its member.An OPC is effectively a company where it can have only one shareholder as its member.

Incorporation of private limited company has a procedure and by following the same company can be structured.In this endeavour, Insta CA which is backed by a team of professionals provides an online platform to facilitate incorporation of the company within a defined timeline. We would require all the necessary documents for incorporating a company and sign up for one of our relevant package and company can be registered with guidance from one of our experts.

Authorized capital stands for the maximum amount of capital that a company can raise by way of issue of shares at present or in the future.Whereas, the Paid-up Capital refers to the actual amount raised by a company i.e., the amount paid by the shareholders on the issuance of shares.With the recent amendments in the Companies Act, one can register a company in India by any amount of paid-up capital which can be less or equal to the authorized capital but not exceeding the authorized capital.

During the registration, a minimum of Rs 1 Lakh should be provided as an authorized capital.A minimum paid-up capital requirement is eliminated as a part of the Government’s initiative to simplify the business registration in India.However, each shareholder must subscribe at least 1 share for the registration.A place of business in India must be provided as a registered office address.

Step 1: Acquire Digital Signature Certificate

Step-2: Name Approval Application: (Part A of SPICe+)

Step-3: ROC Form SPICe+ (Part B of SPICe+)

Step-4: e-MOA, e-AOA, and AGILE-PRO

Digital Signature Certificate is provided in the form of a token issued by Certified Authorities.Any form filed for online company registration in India shall be submitted only after affixing the DSC of an Applicant. Also, the directors will require DSC for DIN application and the subscribers to MOA and AOA shall possess DSC for submitting e-forms for incorporation.

Director Identification Number (DIN) is a unique identification number required for a person to become a director of a company. DIN is issued by the ROC office(Ministry of Corporate Affairs). DIN is to be mentioned in documents while appointing a person as a director of a company. All present or proposed Directors must have a DIN. It never expires and a person can have only one DIN, further with the same DIN, it allows an individual to be a Director in any company or Designated partner in an LLP.