LIMITED LIABILITY PARTNERSHIP

Register your LLP with IbizFilings and save more than

1000/-:

Your LLP With IbizFilings

Registering a Company is quick, easy, and can be done online with Ibiz Filings in 3 simple steps:

We help you register your directors with the Ministry of Corporate Affairs (MCA).

STEP - 1

<span data-metadata=""><span data-buffer="">We help you pick the right company name.

<span data-metadata=""><span data-buffer="">STEP - 2

We draft and file the documents required for your company registration (MoA and AoA).

STEP - 3

Overview

File your Indian company registration in minutes from the comfort of your home or office. Ibizfilings offers hassle-free online company registration in India backed by a team of highly qualified and experienced professionals.

Why Register a Limited Liability Partnership ?

An LLP has a separate legal entity, just like companies. The LLP is distinct from its partners.

The partners of the LLP have limited liability. The liability of the partners is limited to the contributions made by them.

The cost of forming an LLP is low compared to the cost of incorporating a public or private limited company.

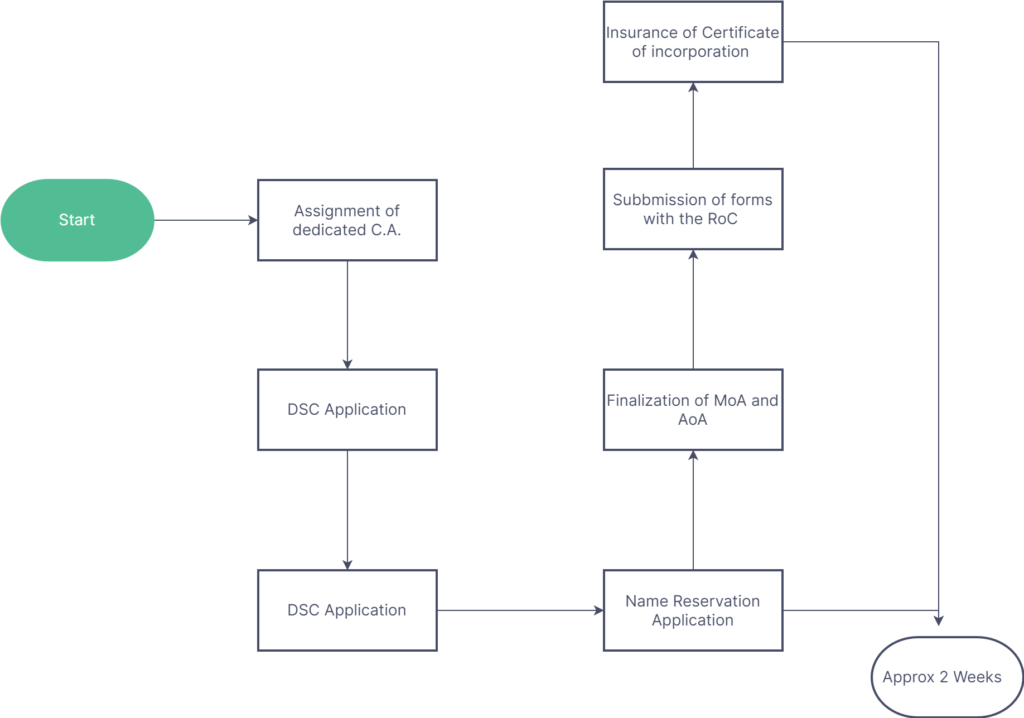

Company Registration Process

Document Checklist

Director KYC documents

- Scanned copies of Pan card and Aadhar of the Partners along with passport size photos

- Scanned copies of any one of the ID Proof of the Partners - Driving License/ Voter’s ID/ Passport copy

- Address Proof of the Partners - Bank Statement/ Telephone Bill/ Mobile Bill/ Electricity Bill (Latest Month scanned copies needed)

Director KYC documents

- Scanned copy of rent Agreement of registered office

- Latest Electricity Bill of registered office

- No Objection Certificate from the owner of the Premises, if not owned by the directors (format of NOC downloadable from dashboard)

Frequently Asked Question

What is an LLP?

A Limited Liabilty Partnership firm (LLP) is a hybrid structure between a partnership firm & a private limited company where the business is carried out in a corporate framework, guided by terms of the mutually adopted partnership deed.

What are the advantages of registering as an LLP over general partnership firms?

- Liability- In a general partnership firm, partners are personally liable for debts of the business which means that even their personal property may be used to settle the firm’s debts. Whereas, the liability of partners is limited in case of an LLP.

- Immunity against wrong doings of other partners- Under LLP structure, partners are not responsible for negligence or misconduct of other partners whereas in general partnership firms, partners can be held responsible.

Does the Income Tax Act treat partnership firms and LLPs differently?

- Both general partnerships and LLPs are taxed at flat rate of 30%.

- All the other income tax act provisions apply similarly except that general partnership firms are covered under presumptive taxation scheme i.e if turnover is below Rs. 2 crore in business or Rs. 50 lakh in case of profession, there is no need to maintain books of accounts or get accounts audited whereas, LLPs are explicitly not covered.

What is the minimum capital requirement for LLPs?

- There is no minimum capital contribution requirement. It can be registered even with Rs. 100 as total capital contribution.

What is the audit requirement for LLP?

- Accounts of an LLP are required to be audited when the turnover is Rs. 40 lakh or more or when the total capital contribution is Rs. 25 lakh or more.

- The auditor of an LLP is appointed annually by the designated partners.

- The first auditor is appointed before the end of the financial year. Subsequent appointment or reappointment of the auditors is made one month before the closing of the financial year by the designated partners.

Do I need to have any prerequisite documents to start an LLP?

- Due to recent changes on MCA portal, incorporation of LLP can only proceed after 2nd October 2018 if any of the partners do not have DIN / DPIN.

My details on my documents have a difference. Can I still incorporate my company using them?

- You will need to have exactly the same details on all your documents to incorporate your company.